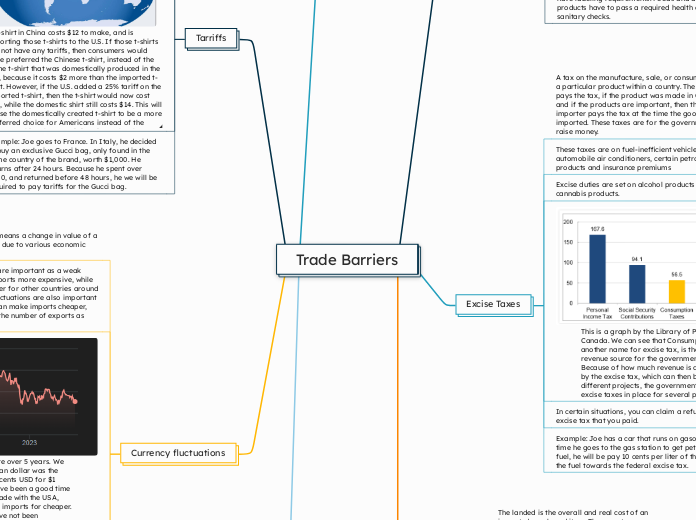

Trade Barriers

Standards

Standards are outlines that are set by the government, which insure that requirement and specifications of a product, the process or the service are consistent with the countries regulations.

This has been done due to different restrictions within each country

We have a world map here. When we (Canadians,) import something from anywhere around the world, the first thing that we would need to check is that if the product meets the import admissibility requirement. If it does, then after the product arrives to Canada, there is an at-border inspection that happens, once that is done, then the product enters Canada. However, it is not done yet, as there needs to be inspection done, as well as several steps that needs to be done, before the product can be in retail stores.

Examples: Goods that will go to retail for selling have labeling requirements. Foods and agricultural products have to pass a required health and sanitary checks.

Excise Taxes

A tax on the manufacture, sale, or consumption of

a particular product within a country. The buyer pays the tax, if the product was made in Canada, and if the products are important, then the importer pays the tax at the time the goods were imported. These taxes are for the government to raise money.

These taxes are on fuel-inefficient vehicles, automobile air conditioners, certain petroleum products and insurance premiums

Excise duties are set on alcohol products and cannabis products.

This is a graph by the Library of Parliament in Canada. We can see that Consumption taxes, another name for excise tax, is the 3rd biggest revenue source for the government of Canada. Because of how much revenue is able to be made by the excise tax, which can then be invested into different projects, the government of Canada has excise taxes in place for several products.

In certain situations, you can claim a refund for the excise tax that you paid.

Example: Joe has a car that runs on gasoline, each time he goes to the gas station to get petrol for his fuel, he will be pay 10 cents per liter of the cost of the fuel towards the federal excise tax.

Landed Cost

The landed is the overall and real cost of an imported purchased item. These costs are composed of the vendor cost, the shipment charges, the tariffs, broker fees, and any other charges.

The total landed cost is the cost that determines if a foreign purchase is a better deal than a domestic purchase.

This is an example of how landed costs are calculated. We can see that there are a lot of factors that are involved, in order to receive the import that we want. These factors are the reason as to why imports can be so expensive.

Example: There is a biscuit brand called 50/50, that has been imported from India to Canada. That product costs $1.20 in India. Because of the landed cost it took to import the product into Canada, that same product now costs $2.97.

Subsidies

A subsidy is money that is given directly or indirectly to a business or an industry, This money

is given in the form of aiding the industry or the business.

This is done for several reasons, and one of the reason include to discourage foreign trade, and to have more domestic products in the country instead.

In Alberta,

Example: Canada provided subsidies to Volkswagen and LG, in order to make more products in Canada, which in result would allow for more domestic purchases, and having more domestic products, instead of having more foreign purchases

Tarriffs

A form of tax on certain types of imports,

which are imposed on a percentage-of-

value basis, i.e. 6% of the retail value or specific value basis, i.e. $6 per 100 kilograms.

One of the reasons as to why Canadian products

are cheaper than finished imported products is because of tariffs, as Canadians can develop the same goods for a lower price, because they made it in Canada.

Example: Joe goes to France. In Italy, he decided

to buy an exclusive Gucci bag, only found in the home country of the brand, worth $1,000. He returns after 24 hours. Because he spent over $200, and returned before 48 hours, he we will be required to pay tariffs for the Gucci bag.

Currency fluctuations

Currency fluctuations means a change in value of a currency. This happens due to various economic conditions.

Currency fluctuations are important as a weak currency can make imports more expensive, while making exports cheaper for other countries around the world. Currency fluctuations are also important as a strong currency can make imports cheaper, but it also can reduce the number of exports as well.

The CAD to USD exchange rate over 5 years. We can see that when the Canadian dollar was the strongest, with it being $0.83 cents USD for $1 Canadian in 2021, it would have been a good time for industries in Canada to trade with the USA, because they would have had imports for cheaper. At the same time, it would have not been preferable for USA to trade with Canada, because the imports for them would have been more expensive. When the Canadian dollar was the weakest, being just $0.70 cents USD for $1 CAD, it would have been a good time for the US to trade with Canada, because its imports would have been cheaper, at the same time, it would not have been a preferred option for Canada to trade with the US, because those imports would cost them more.

Example: Because the Canadian dollar is stronger than the Indian rupee, there will be a lot of imports to Canada from India, and there will less exports from Canada to India.

Embargoes

An embargo is a legal prohibition set by a government, which restricts the export or imports of goods to one or more countries.

Could happen for many reasons, primarily being for political and health reasons

This is an example of the US embargoes with Cuba. In the US, you cannot trade with Cuba, due to the political situations between the US and Cuba. You are also not allowed to freely visit Cuba if you are a US resident.

Example: Since 2022, there have been a lot of embargos from countries around the world. These embargoes have been set towards Russia, in order to discourage them with the war in Ukraine. One of these embargoes includes €43.9 billion worth of goods that would have been exported to Russia, which did not happen, because the European union set the embargoes to eliminate several trades with Russia.