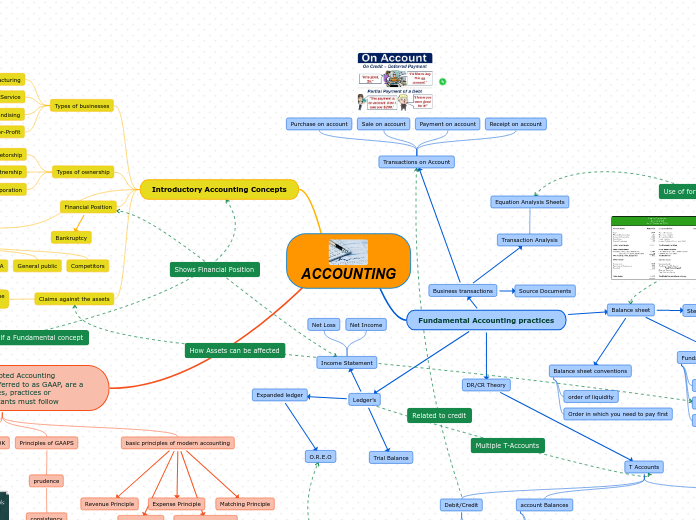

ACCOUNTING

Fundamental Accounting practices

Ledger’s

Trial Balance

Income Statement

Net Loss

Net Income

Expanded ledger

O.R.E.O

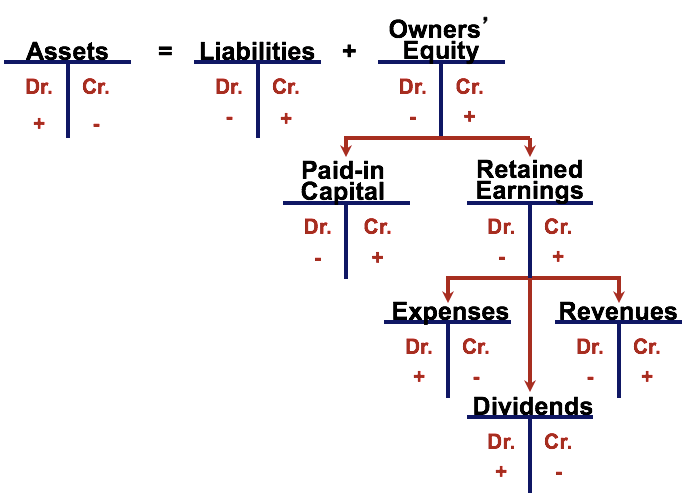

DR/CR Theory

T Accounts

Debit/Credit

Debit = left

Credit = Right

account Balances

Assets = debit; increase credit; decrease

Liabilities & owner’s equity = credit; increase debit; decrease,

exceptional Balances

Asset = credit

Liabilities & Owners equity = debit

Balance sheet

Steps to creating balance sheet

1. Determine the Reporting Date and Period

2. Identify Your Assets

3. Identify Your Liabilities

4. Calculate Shareholders' Equity

5. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets

Balance sheet conventions

order of liquidity

Order in which you need to pay first

Fundamental accounting equation

owner’s equity

Owner's Capital, Revenue, Drawings, Expenses

Assets

Current assets and Fixed Assets, Liquid-non liquid

Liabilities

Long-term Liabilities, Accounts payable,

Business transactions

Source Documents

Transaction Analysis

Equation Analysis Sheets

Transactions on Account

Purchase on account

Sale on account

Payment on account

Receipt on account

Introductory Accounting Concepts

Types of businesses

Manufacturing

Service

Merchandising

Not -for-Profit

Types of ownership

Sole-Proprietorship

Partnership

Corporation

Financial Position

Bankruptcy

User’s of accounting Information

Managers of the company

Shareholders

Bankers/Creditors

CRA

General public

Competitors

Claims against the assets

The claim by the owner or creditor is against the

assets of a business (and not just cash)

GAAPS: Generally Accepted Accounting Principles, commonly referred to as GAAP, are a set of 11 standards, rules, practices or procedures that Accountants must follow

Group’s Compromising GAAPS

FASB & GASB

Business entity’s

AICPA

CICA

Preparers

IFRS

CPA’s/accounting firms

Financial community

Government(SEC)

CICA HANDBOOK

Principles of GAAPS

prudence

consistency

materiality

objectivity

basic principles of modern accounting

Revenue Principle

Expense Principle

Matching Principle

Cost Principle

Objectivity Principle