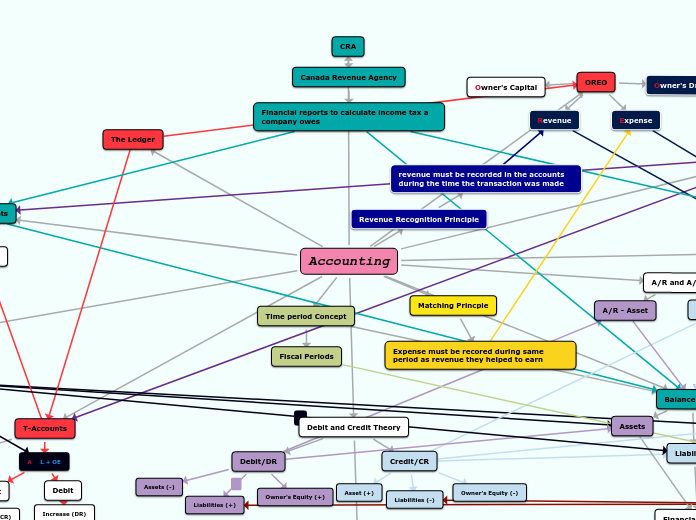

Accounting

Trial Balance Sheets

Debits = Credits

Ex. Trial Balance Sheet

Debit and Credit Theory

Debit/DR

Assets (-)

Liabilities (+)

Owner's Equity (+)

Credit/CR

Liabilities (-)

Owner's Equity (-)

Asset (+)

Ex. Debit&Credit Theory

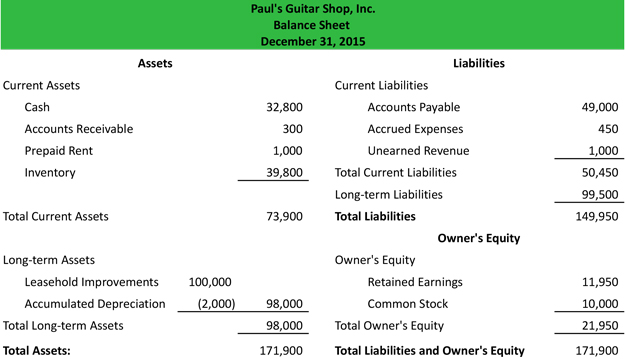

Balance Sheet

Assets

Liabilities

Financial Position

Claim's Against Assets

Owner's Equity

Capital

Ex. Balance Sheet

T-Accounts

A = L + OE

Credit

Decrease (DR)

Increase (CR)

Debit

Increase (DR)

Decrease (CR)

Ex. T-Accounts

A/R and A/P

A/R - Asset

A/P - Liability

Fundamental Accounting Equation

A = L + OE

Income Statement

Revenue

sales of goods and services

Expenses

costs required to earn revenues

Drawings

withdrawals for person use

OREO

Revenue

Expense

Owner's Drawings

Owner's Capital

The Ledger

Account Balances

CRA

Canada Revenue Agency

Financial reports to calculate income tax a company owes

Time period Concept

Fiscal Periods

Matching Princple

Expense must be recored during same period as revenue they helped to earn

Revenue Recognition Principle

revenue must be recorded in the accounts during the time the transaction was made