FIN202 - GROUP 2

SUMMARY

CHAP 1-8

CHAPTER 4: Analyzing Financial Statements

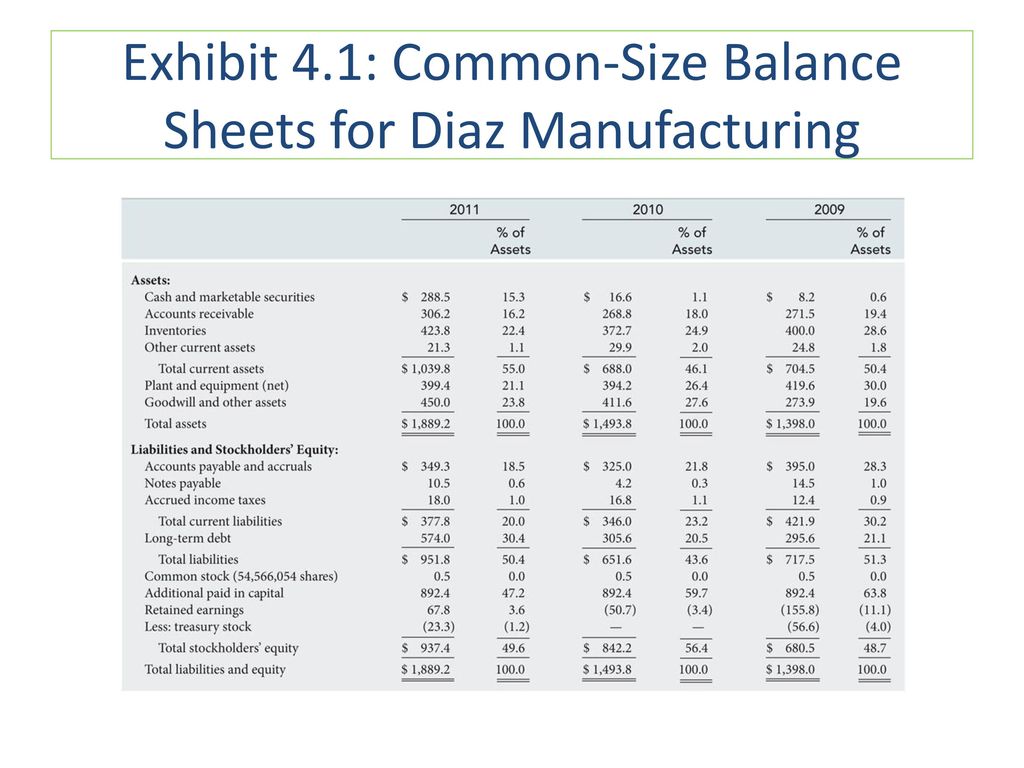

Common size financial statement

Show the dollar amount of each item as a percentage of a reference value (total assets or total revenues)

Standardizes the amount in a balance sheet account by converting the dollar value of each item to its percentage of total assets

Financial Ratios and Firm Performance

Ratios in financial statement

make it easier to compare the performance of large firms to that of small firms

make it easier to compare the current and historical

Ratios used vary across firms

occupancy ratios (hotel)

sales-per-square foot (retailing)

loans-to-assets (banking)

medical cost ratio (health insurance)

Categories of financial ratios

LIQUIDITY RATIOS

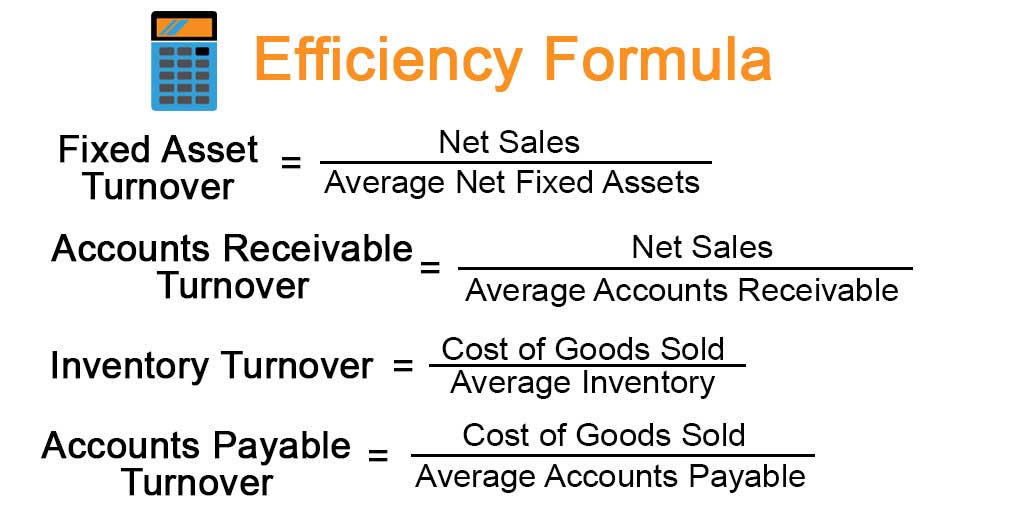

EFFICIENCY RATIOS

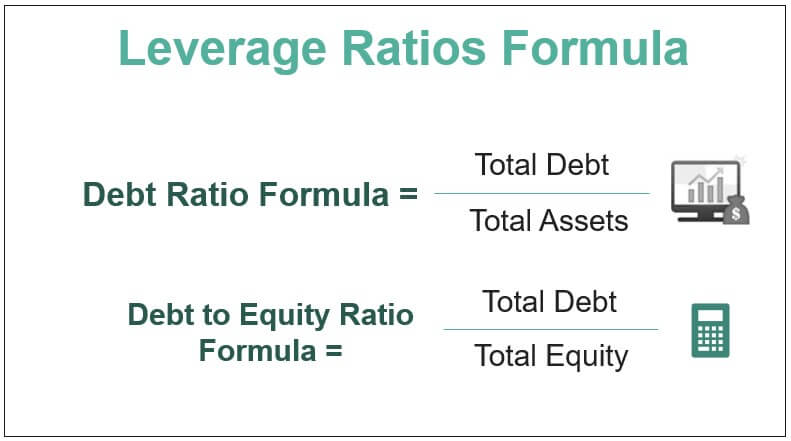

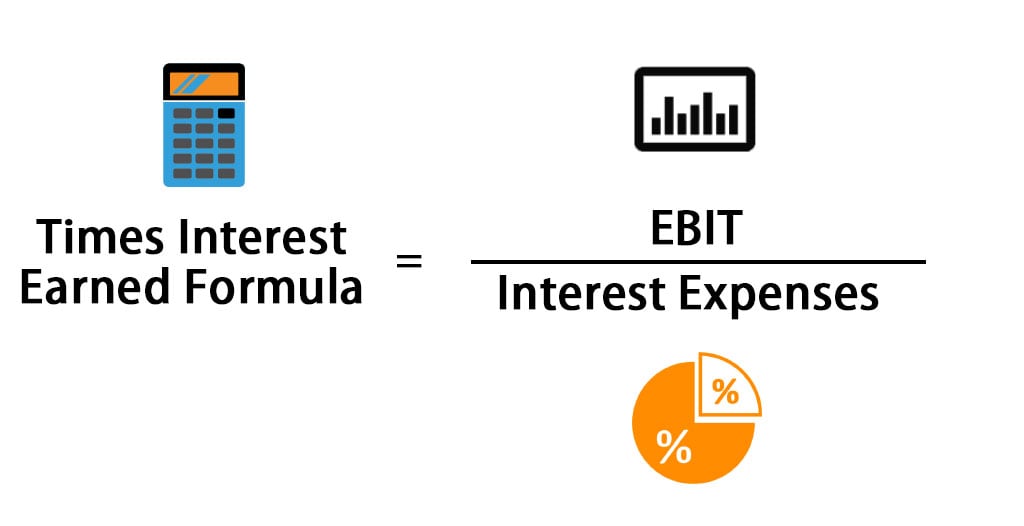

LEVARAGE RATIOS

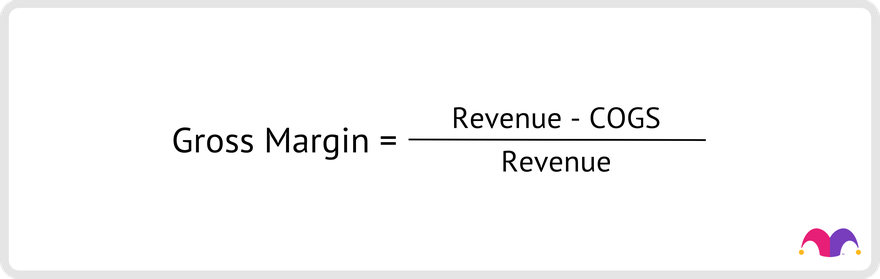

PROFITABILITY RATIOS

MARKET VALUE RATIOS

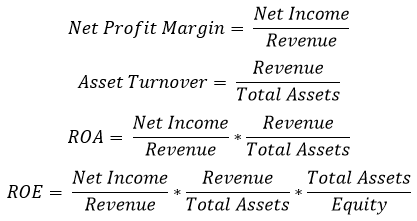

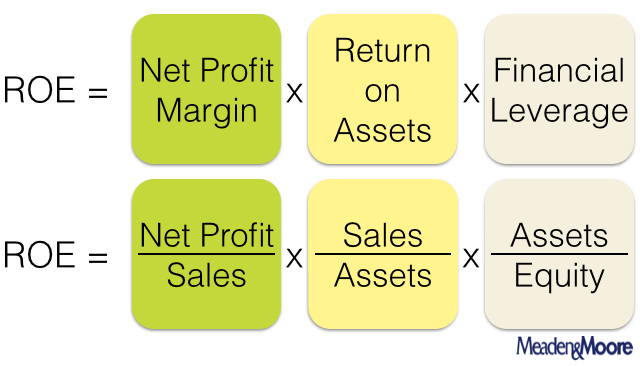

The dupont systems

The dupont systems

Diagnostic tool for evaluating a firm’s financial health

Uses related ratios that link the balance sheet and income statement

Based on two equations that connect a firm’s ROA and ROE

Used by management and shareholders to understand factors that drive ROE

The dupont equation

CHAPTER 5

The Time Value of Money

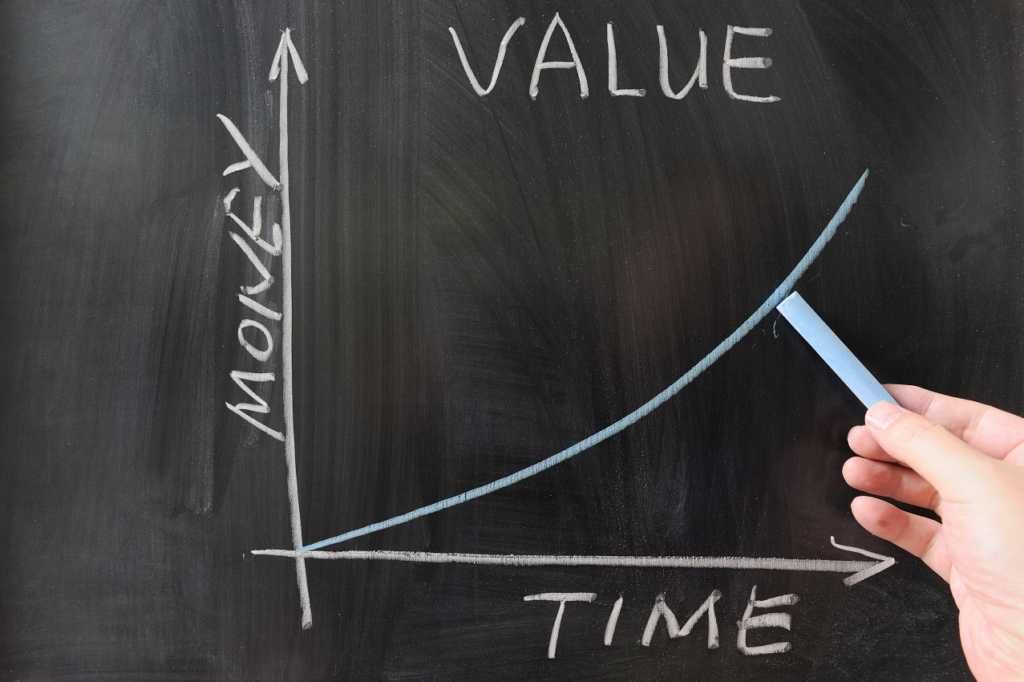

The Time Value of Money (TVM)

Consuming Today or Tomorrow

TVM is based on the belief that people prefer to consume goods today rather than wait to

consume the same goods tomorrow

Money today <= consumption or loaned out for interest

Money borrowed increases wealth and consumption ability

Time Lines as Aids to Problem Solving

Present cash outflows as negative values

Present cash inflows as positive values

Financial Calculator

Future Value and Compounding

Single-Period Investment

Sujet secondaire

FUTURE VALUE EQUATION

FUTURE VALUE OF $1 FOR DIFFERENT PERIODS AND INTEREST RATES

FUTURE VALUE FACTORS

COMPOUNDING MORE THAN ONCE A YEAR

CONTINUOUS COMPOUNDING

Present Value and Discounting

Single-Period Investment

Multiple-Period Investment

The Present Value Equation

Future and Present Value Equations are the Same

Applying the Present Value Formula

The Relations Among Time, the Discount Rate, and Present Value

Future Value Versus Present Value

Additional Concepts and Applications

Finding the Interest Rate

Compound Growth Rates

Chapter 3: Financial Statements, Cash Flows, and Taxes

PURPOSE OF FINANCIAL STATEMENTS

Provide stakeholders a foundation for evaluating the financial health of a firm

Evaluate a firm’s internal environment

Evaluate a firm’s interaction with the external environment

Provide information about the performance of the firm

Financial Statements and Accounting Principles

Generally Accepted Accounting Principles (GAAP)

Public companies must adhere to when they prepare financial statements and reports

INTERNATIONAL GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP)

Uniform accounting rules and procedures promoted by the International Accounting Standards Board

Firms in the European Union are moving toward a “European GAAP”

Economic and political pressure is building in the United States and Europe to develop a unified accounting system

FIVE IMPORTANT ACCOUNTING PRINCIPLES

Assumption of Arm’s Length Transaction

Cost Principle

Realization Principle

Matching Principle

Going Concern Assumption

Chapter 1: The financial manager and the firm

Roles of financial manager

Capital Budgeting

Choose the long-term assets that will yield the greatest net benefits for the firm.

Financial

Finance assets with the optimal combination of short-term debt, long-term debt, and equity.

Working Capital

Adjust current assets and current liabilities as needed to promote growth in cash flow.

Basic Forms of Business Organization

BUSINESS STRUCTURE

Sole Proprietorship

Partnership

Corporation

HYBRID FORMS OF BUSINESS ORGANIZATION

Limited Liability Partnerships (LLPs)

Limited Liability Companies (LLCs)

Professional Companies (PCs)

Simplified Corporate Organization Chart

CHIEF EXECUTIVE OFFICER (CEO)

CHIEF FINANCIAL OFFICER (CFO)

KEY FINANCIAL REPORTS

EXTERNAL AUDITOR

The Goal of the Firm

DO NOT MAXIMIZE MARKET SHARE

DO NOT MAXIMIZE PROFIT

MAXIMIZE SHAREHOLDERS’ WEALTH!

(MAXIMIZE THE VALUE OF THE FIRM’S STOCK)

MAXIMIZE SHAREHOLDERS’ WEALTH!

ITS ALL ABOUT CASH FLOW!

Agency Conflicts

Agency relationship

OWNERSHIP AND CONTROL

AGENCY COSTS

GIVING AGENTS THE RIGHT INCENTIVE

SARBANES-OXLEY AND REGULATORY REFORM

Ethics in Corporate Finance

Chapter 8: Bond Valuationn and the Structure of Interest Rates

Bond Price Information

limited centralized reporting of the sales

Dealers - over - the - counter (OTC)

Thin market

less marketable

less transparent

Price more volatile

Types of coporate bonds

Vanilla Bonds (debentures)

fixed coupon payments

repay principle +retire the bonds at maturity

contract - features and provisions

annual or semiannual

Zero Coupon

sell at deep discount

Convertible Bonds

exchanges for shares of firm's stock

sell a higher price- comparable non- convertible bond

benefit- company's stock gets high market value

Bond Valuation

PB = PV(Coupon Payments) + PV(Par Value)

Par bond ----- coupon rate = market rate

Discount -----coupon rate < market rate

Premium ----- coupon rate > market rate

Yield to Maturity (YTM)

Rate - present value of bond's cash flow

= Price of the bond

changes daily

Effective Annual Yield (EAY)

EAY = ( 1+ Quoted interest rate/m)^m -1

Relized yield

return earned on a bond given the cash flows acctually receive

present value of actual cash flows generated

= bond's price

important- allows investors to see what actually earned

interest rate risk

bond theorems

A number of relations exist between bond prices and changes in interest rates

inversely related - interest rate

interest rate decline - Pb rise

interest rate risé - Pb decline

Prices on longer-term- change more- price of higher coupon bonds

Price of lower- cọupon- change more- price of higher coupon bonds

application

Rate expected to increse - avoid long- term bonds

Rate expected to decrease---- buy zero- coupon bonds

Determinants of corporate borrowing costs

market ability

call provision

default risk

term structure of interest rates

relationship between yield to maturity and term yo maturity on a bond

yield curve

not constant

interest rates change --- curve shifts up and down + changes shape and slope

Chapter 6: Discounted Cash Flows and Valuation

MULTIPLE CASH-FLOW

why cash flows occurring at different times must be adjusted to reflect their value as of a common date before they can be compared?

When making decisions involving cash flows over time, we should first identify the magnitude and timing of the cash flows, and then adjust each individual cash flow to reflect its value as of a common date.

LEVEL CASH-FLOW

ANNUITY

A series of coins of the same distance and length, extending to some limit.

Future Value of Annuity Due

FVA= PVA x future value factor

Present Value of Annuity Due

PVA= CFxPVFA

LOAN AMORTIZATION

How borrowed funds are repaid over the life of a loan

ORDINARY ANNUITY

Annuity in which cash flows occur at the end of a period

ANNUITY DUE

Annuity in which cash flows occur at the beginning of a period

PERPETUITY

A series of equally-spaced and level cash flows that continue forever

PVP=CF/i

GROWING PERPETUITY

GROWING ANNUITY

GROWING PERPETUITY

Sujet secondaire

EFFECTIVE ANNUAL INTEREST RATE

INTEREST RATES

quote interest rates is in terms of annual percentage rate (APR)

APR = (periodic rate) x m

to quote interest rates is in terms of effective annual rate (EAR)