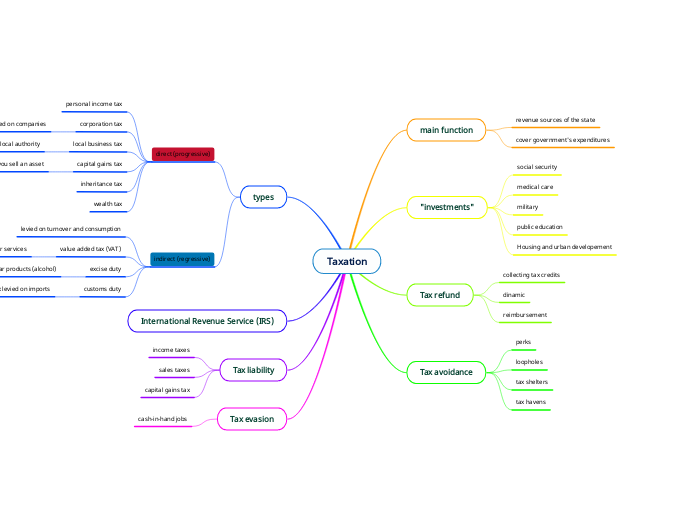

Taxation

main function

revenue sources of the state

cover government's expenditures

"investments"

social security

medical care

military

public education

Housing and urban developement

Tax refund

collecting tax credits

dinamic

reimbursement

Tax avoidance

perks

loopholes

tax shelters

tax havens

types

direct (progressive)

personal income tax

corporation tax

levied on companies

local business tax

companies pay to the local authority

capital gains tax

tax you pay when you sell an asset

inheritance tax

wealth tax

indirect (regressive)

levied on turnover and consumption

value added tax (VAT)

tax paid at each point of exchange of goods or services

excise duty

tax levied on particular products (alcohol)

customs duty

tax levied on imports

International Revenue Service (IRS)

Tax liability

income taxes

sales taxes

capital gains tax

Tax evasion

cash-in-hand jobs