Ballance sheets

Owners equity

Net worth LEFT OVER

Own - owe = left over

Assets - Liabilities = networth

Liabilities (bad)

Debts OWED buy the business

EXAMPLE bills not paid yet, loans, taxes

Assets (good)

Anything OWNED that has $ value

EXAMPLE stocks, cash

Intro to balance sheet

formal financial statement shows what is owned, owed & networth

shows a financial picture as of a CERTAIN DATE

income statments

Formal financial statement

Shows how much profit or loss the business made over a period of time.

Shows a sheet of the profit or loss over time.

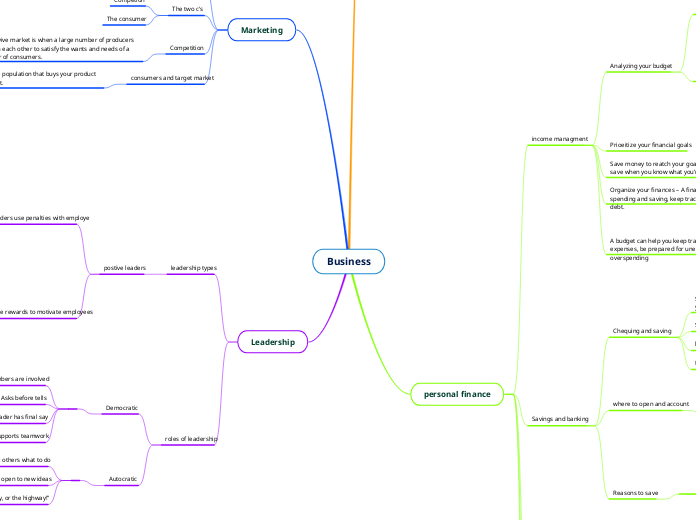

income managment

Analyzing your budget

Cut spending Making a small changes can add up to big savings

5 Questions to ask yourself

Do you eat out a lot? Could you cook more of your meals at home?

Do you buy coffee on the way to work each day? Could you briring coffee from home?

Do you pay a lot of fees for a cell phone? Could you get a cheaper plan? Do you still have a landline? WHY?

Could you cut back on cable or satellite service?

Do you spend a lot on gas for your car? Could you drive less?

Prioeitize your financial goals

Save money to reatch your goals – You may find it easier to save when you know what you’re saving for.

Organize your finances – A financial plan can help you balance spending and saving, keep track of expenses and manage debt.

A budget can help you keep track of your income and expenses, be prepared for unexpected expenses and avoid overspending

components of a budget

REVENUE Income after taxes (YOUR NET, NOT GROSS)

EXPENSES Fixed monthly expenses Variable expenses Occasional expenses

Budget surplus vs deficit

If your revenue>expanses you have a net income (like accounting)This means you have money leftover - a Budget surplus

If you spend more than you earn, you have a budget deficit

Savings and banking

Chequing and saving

Savings and chequing accounts are safe place to put money you plan to spend soon

Saving accounts – allow you to set money aside

build funds for your education

for emergencies, save for a large purchase or

where to open and account

You can open an account at any of these financial institutions. They provide the same kinds of banking services for chequing and savings accounts, but they are run differently

Banks and trust companies – make money for the people who own their shares.

Credit unions – owned and run by the members who bank there. They may charge a refundable membership fee to join.

Reasons to save

FINANCIAL SECURITY

Emergency funds

Buy a car

Buy a house

Pay for your kids to go to school

Retirement

Cheques

Before writing a cheque you must have a chequing account

A cheque is only valid for 6 months

On a cheque you need to (1) write your name (2) write the amount of money you want to pay and (3) the date

payroll and decoctions

By LAW, your employer must take each of the 3 deductions off of your paycheque and send the money to the government.

Health Care, Jails, Education, Roads, Welfare/Social Assistance

Government deductions pay for public services such as Police

CPP: Canada Pension Plan

- anyone who works & is over 18 years old contributes to CPP

- when you retire, become disabled, or should your spouse pass away, you can receive CPPEI:

El Employment Insurance

pay into it from EVERY paycheque, even if you are not yet 18.

interest

The rule of 72

Divide the rule number (72) by the annual interest rate (R) to find out the approximate time (T) required for doubling

The rule of 72 is useful for savings goals, retirment goals and comparing investments

The four p's

product, price, promtion, place

The two c's

Competion

The consumer

Competition

The competivive market is when a large number of producers compete with each other to satisfy the wants and needs of a large number of consumers.

Market share is the percentage of the market that a company or brand has.

consumers and target market

The specific segment of the population that buys your product is called your Target market.

leadership types

postive leaders

Negative leaders use penalties with employe

These leaders act domineering and superior with people Negative penalties include:

Days off without pay

repimanding in front of others

assigning unpleasant job tasks

Positive leaders use rewards to motivate employees

independence

development opportunities

acknowledgement

raises, bounses

time off

roles of leadership

Democratic

All members are involved

Asks before tells

Leader has final say

Supports teamwork

Autocratic

Tell others what to do

Not open to new ideas

“It’s my way, or the highway!”