Market

Demand

Law of Demand

Speculative Demand

Ostentatious Consumption

Supply

Law of Supply

Supply Schedule

Elasticity

Cross Elasticity

Price Elasticity of Supply

Price Elasticity of Demand

Demand for Money

Keynesian Motives

Transactions

Precautionary

Speculative

Influence

Price Level

Income

Interest Rate

Credit Availability

Banks

Central

Commercial

non-commercial

Monetary Policy

Open Market Operations

Reserved Requirements Policy

Discounts Rate Policy

Insurance Companies

Savings

Loan Associations

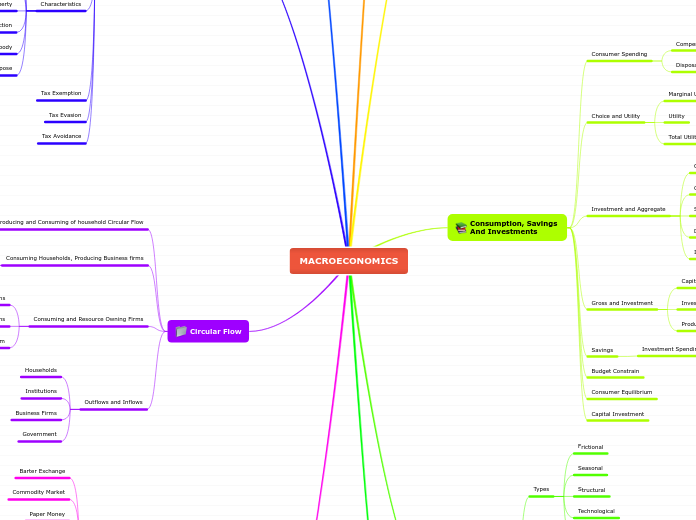

Consumer Spending

Compensatory to Spread

Disposable Income and Spending

Choice and Utility

Marginal Utility

Utility

Total Utility

Investment and Aggregate

Quality Investment

Capacity, Costs , and Competitiveness

Supply Side Effects

Demand side Effects

Investments and Jobs

Gross and Investment

Capital Depreciation

Investment

Productive Capacity

Savings

Investment Spending Identity

Budget Constrain

Consumer Equilibrium

Capital Investment

Types

Frictional

Seasonal

Structural

Technological

Cyclical

Labor Force Participation

Labor Force

Employed and Unemployment

Hidden Employment

Underemployed

Discouraged Workers

Consumer Price Index

Demand-Pull Inflation

Cost-Pull Inflation

Wage-Price Standard

Profit Push Inflation

Supply-Side Cost Shock

Basis of Trade

Trading

Law of Absolute Advantage

Law of Comparative Advantage

Trade Barriers

Tariffs

Quotas

Voluntary Export Restrictions

Non-Tariff Trade Barriers

Foreign Exchange Rates

Classical Gold Standard

Pure Floating Exchange Rates

Hybrid System

Protectionism

Fixed Exchanged Rate

Pegged Float Exchange Rate

Pegged Float Regimes

Crawling Bands

Crawling Pegs

Pegged with Horizontal Bands

Measuring National Outputs and Income

GDP

GNP

Measuring National Income

Value Added Approach

Factor Income Approach

Factor Expenditure Approach

Purchase of Goods, Services

And Expenses

Amount and type of

Expenses

Government and Economy

Economic Function

Taxation

Objectives

Production of goods and services

Protection of tariffs

Redistribution

Sugarplum

Approaches

Benefits Recieved

Ability to pay

Characteristics

Enforce Contribution

Generally payable in money

Proportionate in Character

Levied on persons and property

Levied by the state and jurisdiction

Levied by the law making body

Levied for public purpose

Tax Exemption

Tax Evasion

Tax Avoidance

Producing and Consuming of household Circular Flow

Households

Consuming Households, Producing Business firms

Business Firms

households

Consuming and Resource Owning Firms

Raw Material Business Firms

Intermediate Business Firms

Final Goods business firm

Outflows and Inflows

Households

Institutions

Business Firms

Government

Evolution of money

Barter Exchange

Commodity Market

Paper Money

Bank Money

E-Money

Digital Money

Functions of money

Medium of Exchange

Measure of Value

Store of Wealth

Characteristics of Money

Portable

Durable

Homogeneous

Divisible

Intrinsic Value

Money Supply

M1

Transactions Money

Check-able Deposits

M2

Broad Money

Funds

Savings

Deposit

M3