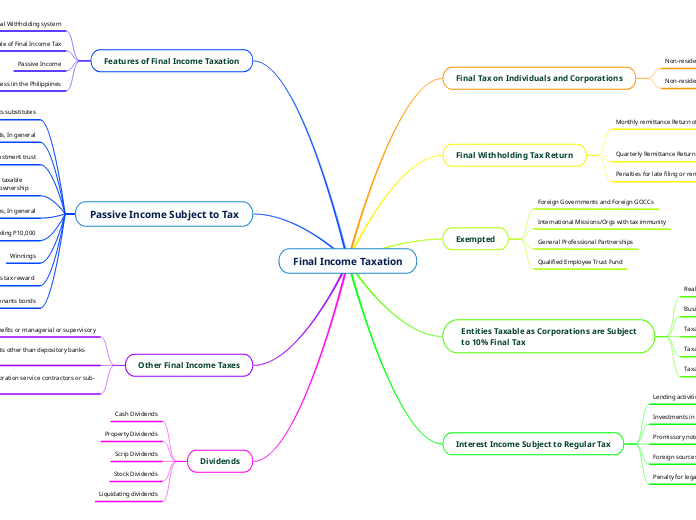

Final Income Taxation

Final Tax on Individuals and Corporations

Non-resident alien not engaged in trade or business

Non-resident foreign corporation

Final Withholding Tax Return

Monthly remittance Return of Final Income Taxes Withheld

Monthly manual filing

Monthly deadline for eFPS filing

Quarterly Remittance Return of Final Income Taxes Withheld

Penalties for late filing or remittance of final income taxes

Exempted

Foreign Governments and Foreign GOCCs

International Missions/Orgs with tax immunity

General Professional Partnerships

Qualified Employee Trust Fund

Entities Taxable as Corporations are Subject to 10% Final Tax

Real Estate Investment Trusts

Business Partnerships

Taxable associations

Taxable joint ventures, joint accounts or consortia

Taxable co-ownerships

Interest Income Subject to Regular Tax

Lending activities, whether or not in the course of business

Investments in corporate bonds

Promissory notes

Foreign sources, whether bank or non-bank

Penalty for legal delay or default

Features of Final Income Taxation

Final Withholding system

Rationale of Final Income Tax

Passive Income

Non-resident persons not egaged i business iin the Philippiines

Passive Income Subject to Tax

Interest or yield from bank deposits or deposits substitutes

Domestic dividends, In general

Dividend income from a real estate investment trust

Share in the net income of a business partnership, taxable associations, joint venture, joints accounts, or cor-ownership

Royalties, In general

Prizes exceeding P10,000

Winnings

Informer's tax reward

Interest income on tax-free corporate covenants bonds

Other Final Income Taxes

Fringe benefits or managerial or supervisory

Income payments of residents other than depository banks under EFCDS and EFCDUs

Income payments to oil exploration service contractors or sub-contractors

Dividends

Cash Dividends

Property Dividends

Scrip Dividends

Stock Dividends

Liquidating dividends