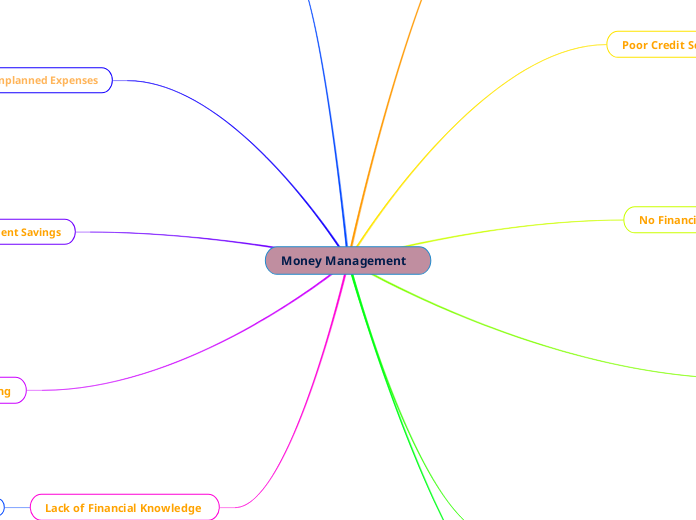

Money Management

Insufficient Savings

Savings Strategies

Set Savings Goals (e.g., Retirement, Education, Home)

Automate Savings

Create an Emergency Fund

Poor Credit Score

Credit Management

Check and Monitor Your Credit Score

Pay Bills on Time

Reduce Credit Card Balances

Avoid Opening Unnecessary Credit Accounts

No Financial Safety Net

Insurance and Estate Planningc

Consider Life Insurance

Create a Will or Trust

Purchase Health, Auto, and Home Insurance

Procrastination

Action and Discipline

Take Action Today

Develop Financial Discipline

Hold Yourself Accountable

Seek Support from a Financial Coach or Mentor

Overspending

Budgeting and Expense Control

Create a Budget

Track Expenses

Cut Unnecessary Spending

Use Envelopes or Apps for Cash Management

Lack of Investment

Investment Knowledge

Learn About Different Investment Options (Stocks, Bonds, Real Estate)

Diversify Your Portfolio

Consult a Financial Advisor

High-interest Debt

Debt Management

Prioritize Paying Down High-Interest Debt

Consolidate or Refinance Loans

Negotiate Lower Interest Rates

Unplanned Expenses

Emergency Planning

Avoid Impulse Spending

Have a Contingency Plan

Build an Emergency Fund

No Retirement Savings

Start Saving for Retirement

Open a IRA Account

Contribute Regularly

Take Advantage of Employer Matching

Inadequate Goal Setting

Set Clear Financial Goals

Define Short-Term, Medium-Term, and Long-Term Goals

Break Down Goals into Achievable Steps

Review and Adjust Goals Regularly

Lack of Financial Knowledge

Financial Education

Books

Online Courses

Workshops

Seek Advice from Financial Advisors