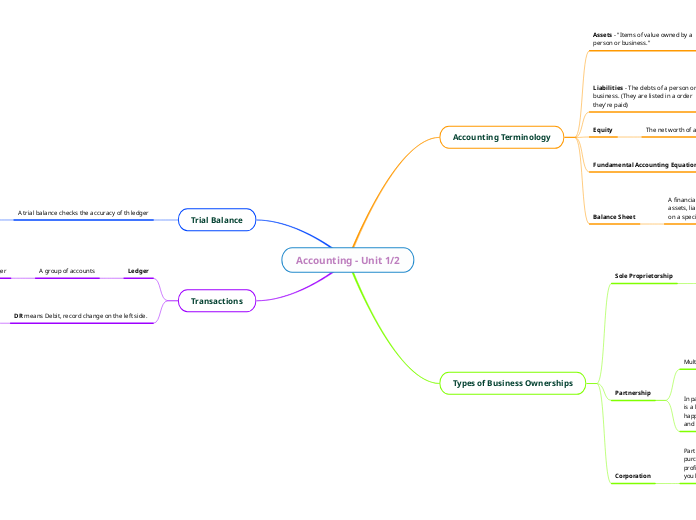

Accounting - Unit 1/2

Accounting Terminology

Assets - "Items of value owned by a

person or business."

Current Assets - An asset that will be

converted to cash, sold or consumed

within one year.

Cash, Accounts Receivable, Office

Supplies

Fixed Assets - Assets that have a long

life. They aren't intended to be sold.

Land (longest life), Building,

Equipment, Automobile

Liabilities - The debts of a person or

business. (They are listed in a order

they're paid)

Accounts payable (Paid within 30

days), Bank Loan and, Mortgage

Equity

The net worth of a person or business.

Fundamental Accounting Equation

Assets = Liabilities + Owner's Equity

Owner's Equity = Assets - Liabilities

Balance Sheet

A financial statement that lists

assets, liabilities and owner's equity

on a specific date.

Balance sheets are used to show the

financial position of a business or

even individual on a certain date.

Types of Business Ownerships

Sole Proprietorship

Your own business

Advantages : You're your own boss and

it's inexpensive.

Disadvantages : Can't afford to be

sick, no holidays, etc. You're also

using your own limited money.

Partnership

Multiple person business

Advantages : Able to do other things

on the side without worrying. Both are

investing money, which means able o

afford more things. More ideas/pitches.

Disadvantages : Profits have to be

distributed.

In partnership businesses, you there

is a legal agreement so, if anything

happens you aren't only responsible

and there is equal payment.

Corporation

Part Owner of higher businesses, you

purchase shares which is a share of

profit the company makes. (Ex; Each share is worth 50 cents, you have 5 shares...you would then have made $2.50)

Advantages : You only lose the amount

of money you invest.

Disadvantages : If the business isn't

doing well and making no profit,

you're also gaining nothing

Trial Balance

A trial balance checks the accuracy of th ledger

DEBITS = THE CREDITS

Transactions

Ledger

A group of accounts

Rules for Creating a Ledger

For all Assets : You start on the debit side (left).

For all Liabilities : You start on the credit side (right).

For Capital : You start on the credit side as well.

DR means Debit, record change on the left side.

CR means Credit, record change on the right side.