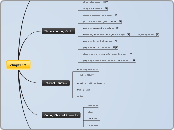

chapter 2

Accounting vs Bookkeeping

The Accounting Cycle

obtain information

analyze transactions

record transactions in a journal

post from journal to general ledger

prepare unadjusted trial balance

record adjust entries/post to general ledger

adjusting entries

prepare adjusted trial balance

prepare financial statements

close temporary accounts to retained earnings

prepare post-closing trail balance (year end only)

Internal Controls

numbering documents

physical security

equality of debits and credits

trial balances

audits

Coding Chart of Accounts

sequential

block

hierarchical

mnemonic