by Mindomo Team 2 years ago

498509

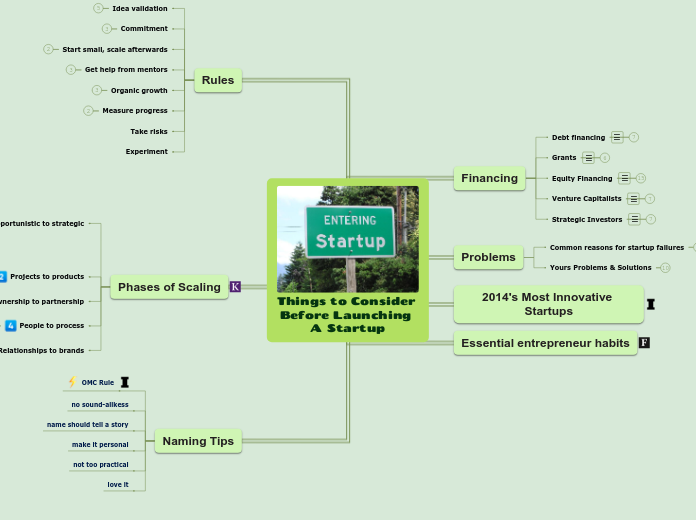

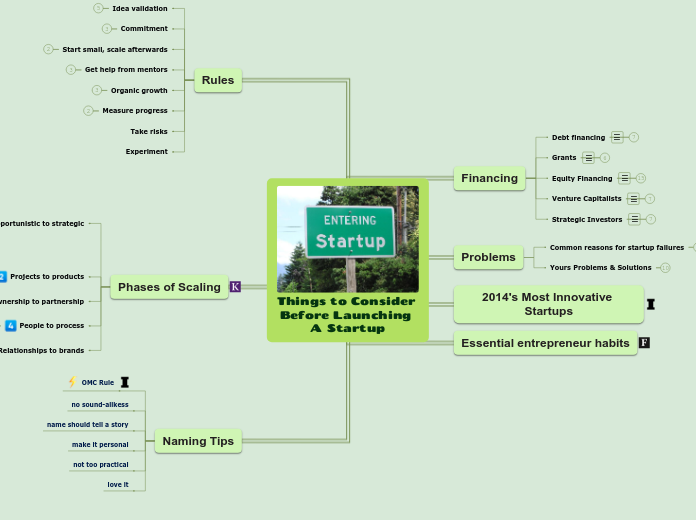

How To Create a Startup Company

by Mindomo Team 2 years ago

498509

More like this

less risk for customer abandonment when a key salesperson departs

CEO and leadership team spread their know how

"You're not going to grow until you let go."

uncomfortable for most

no dependency on a few key people

important relationships

protected intellectual property

your brand is not always in front of the customers

partners become competitors

Materiality

Margin

What are the areas in which you have profitability?

Momentum

To what extent are your sales growing, how much traction are you getting, what is the market's response?

achievement

new products/services take up all cash flow

avoid major mistakes

save money and time

real people

feedback

personal email branding

LinkedIn profile that ranks in the top for your industry

reliable solution for shared presentations, applications, document sharing and desktop sharing

web hosting with unlimited bandwidth and data transfer

tool that lets you schedule and publish content across multiple platforms.

Equity financiers who get their name because they come from within the industry you are targeting and find what you’re selling to be “strategic” for their business objectives (such as somehow complementing or enabling the products or services they sell).

can prohibit you from selling to their competitors

dependency can be risky

can force you to recalibrate your entire business to serve them

money can come with access to benefits like manufacturing, distribution, and marketing

enhance your credibility in the industry

Funding pros are serious players in the investing world who look to get their money and profits out as quickly as possible.

must be prepared to share control

must be interested in selling the business or going public within three to five years

must be a “fast growth” startup business

have more money if you need more to grow

Private or “institutional” investors in exchange for an equity ownership stake.

Private investors who have earned their name “angels” by typically being friendly and patient about their investments and by providing their business wisdom and valuable relationships along with their money. They often like to invest in groups, each taking a piece of the deal. Comfort zone: $25,000 to $1 million.

hard to manage the divergent interests of a large group of angels

often difficult to find

relatively patient about their investments

invest smarts and networking in addition to money

Business has risks, and preserving your relationships with friends and family is at least as important as your business opportunities.

Comfort zone: generally less than $50,000.

money loss might ruin relationships

limited one-time source of funding

available quickly

fewest contractual strings attached

convenient

There are also numerous state, regional and minority grant opportunities available.

use of funds is strictly defined

highly competitive

investors love the “leverage” that grants provide

free money

Banks can provide you with a loan or line of credit that comes with a repayment schedule and an interest rate.

may require personal collateral such as home

limited networking

must pay interest

available to companies that can’t get equity funding

keep equity