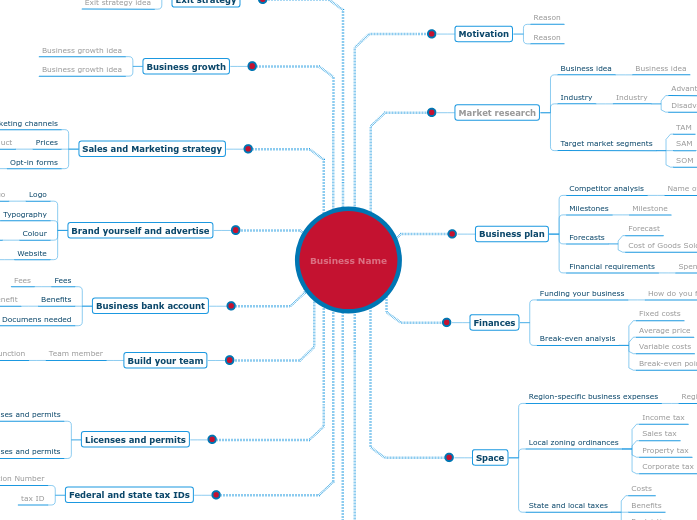

You want to know how to start a business from scratch? Use this template to create a strategy for starting a business. Starting a business can be difficult, but following these steps will help you. Think about the reasons why you are starting a business. These reasons will motivate you not to give up in case you find it difficult along the way. Set goals and follow them. Also, think about building a business that will assure you a job that caters to your strengths. Before starting a business, you have to find information about people’s interests. Do some market research to find out what product or service they are interested in. Think about a business idea that nobody tried before. You need only one business idea, but that idea must ensure your success. Think about the type of activity that your company will perform. Analyze the existing industries and choose one of them. Some examples of popular industries are: The Business Services Industry; The Food and Restaurant Industry; The Food and Restaurant Industry; The General Retail Industry; The Technology Industry; The Health, Beauty, and Fitness Industry; The In-Home Care Industry; The In-Home Cleaning and Maintenance Industry; The Sports and Recreation Industry; The Travel and Lodging Industry; The Automotive Repair Industry. Think about the advantages and disadvantages of investing in each industry. In the market research stage, you will have to define your target market segments. The target market refers to customers with similar characteristics that are most likely to be profitable segments for your business. To attract new investors and customers for your small business you have to write a business plan. There are four types of business plans: operational plan, strategic plan, tactical plan, and contingency plan. Every business has competition. First, think about your competitors. Who are they? What are their strengths and weaknesses? Think of ways to implement their good features in your business and to capitalize on their weaknesses. Set goals. Show investors that you have some milestones. For example, if you are producing a consumer product, you can have milestones like prototypes or finding manufacturers. If you are a product company, break down your forecast into major product categories. Think about the expenses related to making your product or delivering your service (cost of goods sold). This does not include regular business expenses such as rent, insurance, salaries, etc. In the financial requirements section of your plan, show investors how you are going to spend the money they will give you. Some major areas can be marketing, sales, and purchasing inventory. Calculate the budget you will need from the beginning. Start building a business only when you have all the necessary money. Also, it is possible to incur unforeseen expenses, so you have to prepare for that. When you will try to find a space for your business, take into consideration some aspects like region-specific business expenses, local zoning ordinances, and state and local taxes. There are many types of business. Learn about the various legal business structures that are available. Determine which type of entity is the best for your needs. Depending on the structure, the businesses are grouped in: Sole proprietorship; Partnership; Limited liability company; Corporation. The most common type of organization is the sole proprietorship. It is a business that can be owned and controlled by an individual, a company, or a limited liability partnership. To become an officially recognized business entity, you must register your business. You will need a well-defined business purpose. This is the reason you have formed your company boiled down to a single sentence. Also, you have to declare the types of stocks you have. There are four types of stocks that an investor should own: Growth stocks - the shares you buy for capital growth; Dividend stocks - stocks of choice for the income-seeking investors; Initial Public Offerings - stocks that mark the first time that companies make their shares available to the public; Defensive stocks - stocks that provide a constant dividend and report stable earnings regardless of the state of the share market as a whole. Learn how to organize your taxes and prepare for making a profit. You’ll need your employer identification number (EIN) for essential steps to start and grow your business, like opening a bank account and paying taxes. Some states require you to get a tax ID as well. If your business activities are regulated by federal agencies, you will need to get a federal license or permit. The licenses and permits you need from the state, county, or city will depend on your business activities and business location. If your business is a sole proprietorship and offers services to customers, professional liability insurance is worth considering. Converting your idea into a successful business might be a full-time job for you, but you can not do everything on your own. Recruit some employees to help you. Write job postings on various job platforms. Make sure you find people that will be interested in a long-term collaboration, so you can plan everything in detail and define each task based on the number of employees you have. If their long-term goal is to help your business grow, then they are the perfect candidates. There are many bank accounts to choose from and each of them has benefits. Find a business bank account that suits your needs. Look some of the following benefits: Low introductory offers; Low-interest rates for savings and checking; Low-interest rates for lines of credit; Low transaction fees; Early termination fees; Minimum account balance fees. Before you start selling your product or service, you need to build your brand.Create a logo that can help people easily identify your brand. Choose a font pair and a color for your brand. Business owners usually create a website at this point using a content management system platform or hire somebody to build the website for them. Think about a marketing plan and contact suppliers in advance. Find different ways to promote your business. Sell your product or service through many marketing channels like social media, email marketing, content marketing, and Pay-Per-Click marketing. First, make a list of email addresses and promote your business in a free and easy way through e-mail marketing. At some point, you can automate the process of sending emails. While doing SEO optimization, run some paid campaigns. You can also use email addresses from people that showed interest to retarget them with Facebook Ads campaigns. A small business is a good start. Although, if you want a successful business, you have to think about some growth strategies. Some strategies that help business owners to grow their business are: Collaborate with more established brands in their industry; Partner with a charity organization; Volunteer; Attend networking events; Host events; Offer great customer service; Measure what works and refine their approach. Establish some long-term business goals like increasing overall brand awareness or increasing the total income of your company by 20% over the next three years. Business owners should always be positive but also cautious. Prepare an exit strategy in case your business idea does not work. Here you have some examples: Sell your small business to investors; Sell it to another company; Turn it into an online business to reduce taxes; Make as much money as possible, then close it down. Starting a business means investing time and money. Prepare for that and make sure you will get the expected results. Think of a name for your business. To become an officially recognized business entity, you must register with the government. Stock type There are four types of stocks that an investor should own: Type in stock type or choose from the list below. Your business purpose is the reason you have formed your company boiled down to a single sentence. Your business purpose is the reason you have formed your company boiled down to a single sentence. You’ll use your employer identification number (EIN) for essential steps to start and grow your business, like opening a bank account and paying taxes. Tax Identification numbers can be found on tax assessments in the right upper corner on the first page. The Employer Identification Number is a unique nine-digit number assigned by the Internal Revenue Service to business entities operating in the United States for the purposes of identification. The licenses and permits you need for your business will vary by industry, state, location, and other factors. What are the state license and permit you already have? Issuing agency What is the issuing agency of your federal license or permit? Description Type in a description of your business. Business activity What is your business activity? Unless you're planning to be your only employee, you will need to hire a great team to start your company. Type in his/her name. Function What is his function in your business? When you are trying to open a business bank account, think about the benefits it should offer: Document name Documents you need: Which of these documents do you have? Choose benefit There are a lot of bank accounts with benefits out there, but you have to be careful that the one you choose is worth the money. How do you consider the fees you will pay for the bank you found? If they are too high, think about changing it. Before you start selling your product or service, you need to build up your brand. Website name Type in the name of your website. Choose the colours for your brand. Font Choose a font pair to build your brand. Create a logo that can help people easily identify your brand. Create a sales and Marketing strategy Ask your customers and potential customers for permission to communicate with them. Product Type in the names of your products. Price Type in its price. Choose from these ones or add other marketing channels that you think will help you promote your business in the best way. Marketing channel Type in some ideas to grow your business. Consider an exit strategy in case your business does not work. Before you can register your company, you need to decide what kind of entity it is. Your business location is an important decision. The choices you make could affect your taxes, legal requirements, and revenue. Restrictions Type in restrictions. Benefits Type in benefits. Costs As a business owner, it’s important to understand your federal, state, and local tax requirements. Corporate tax What is the corporate tax? Property tax What is the property tax? Sales tax What is the sales tax? Income tax What is the income tax? Type in region-specific business expenses. Starting any business has a price, so you need to determine how you're going to cover those costs. Break-even point The break-even point is the level of production at which the costs of production equal the revenues for a product. Variable costs Variable costs are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of marginal costs over all units produced. Average price To calculate the average purchase price of your shares you have to divide the total amount invested by the total number of shares bought. Fixed costs Fixed expenses or costs are those that do not fluctuate with changes in production level or sales volume. How do you fund it? Choose from these ones or add other ways of funding. There are four types of plans: Spent funds If you are raising money from investors, you should include a brief section of your business plan that details exactly how you plan on using your investors’ cash. Cost of Goods Sold This shows the expenses related to making your product or delivering your service. Forecast For example, If you are a product company, break down your forecast by target market segments or into major product categories. Milestone Schedule the next critical steps for your business. Name of your competitor Type in the name of your competitor. SOM Type in SOM. SAM Type in SAM. TAM Type in TAM. Choose from the list below or type in an industry you want to analyze. Disadvantage Type in disadvantage. Advantage Type in advantage. Gather information about potential customers and businesses already operating in your area. Use that information to find a competitive advantage for your business. What is your motivation? Type in the reasons for starting a business. Los mapas mentales ayudan a realizar lluvias de ideas, establecer relaciones entre conceptos, organizar y generar ideas. Sin embargo, las modelos de mapas mentales ofrecen una forma más fácil de empezar, ya que son estructuras que contienen información sobre un tema específico con instrucciones orientativas. En esencia, las modelos de mapas mentales garantizan la estructura que combina todos los elementos de un tema específico y sirven como punto de partida para su mapa mental personal. Son un recurso que proporciona una solución práctica para crear un mapa mental sobre un tema concreto, ya sea para los negocios o para la educación. Mindomo le ofrece modelos de mapas mentales inteligentes que le permiten funcionar y pensar sin esfuerzo. Puede elegir entre una variedad de modelos de mapas mentales de las cuentas empresariales o educativas de Mindomo, o puede crear sus propios modelos de mapas mentales desde cero. Cualquier mapa mental puede transformarse en un mapa plantilla añadiendo notas orientativas a uno de sus temas.Start your business template

Starting your own business is an amazing journey. Try to do it from the beginning in an organized way. Plan everything and visualize your result.

Keywords: business management, small business, starting a business, business organization, business expenses, market research, business plan

How to start and launch your business from scratch

Motivate yourself.

Do market research.

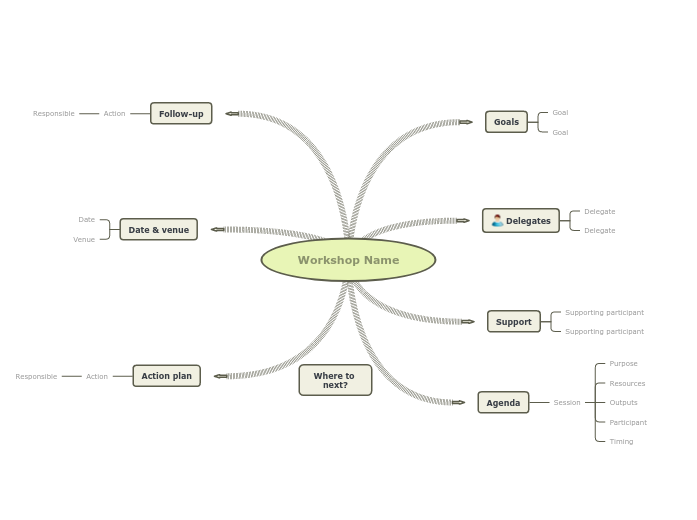

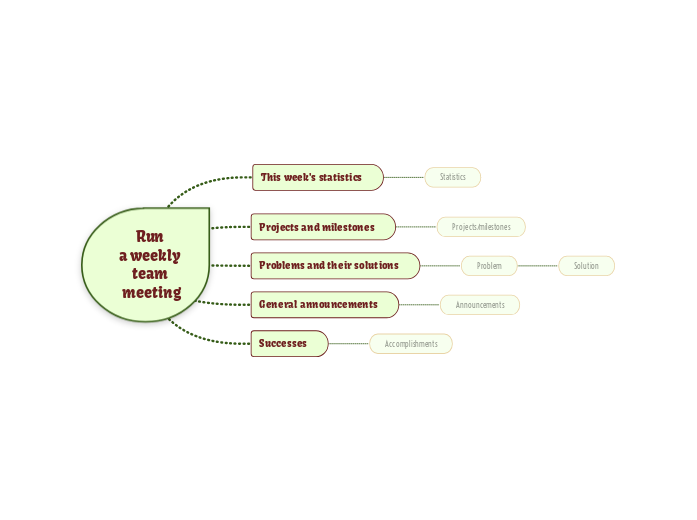

Write a business plan.

Think about finances.

Find a place to carry out your activity.

Decide what kind of structure you want for your business.

Register your business.

Get federal and state tax IDs.

Get licenses and permits.

Build your team.

Find a bank account suitable for your needs.

Brand yourself and advertise.

Create a sales and marketing strategy.

Grow your business.

Think about an exit strategy.

Business Name

Business registration

Corporations will need an 'articles of incorporation' document, which includes your business name, business purpose, corporate structure, stock details, and other information about your company.Types of stocks

Business purpose

What is your business purpose?Federal and state tax IDs

Some states require you to get a tax ID as well.tax ID

Get federal and state tax ID.Employer Identification Number

Apply for an Employer Identification Number.Licenses and permits

Requirements and fees depend on your business activity and the agency issuing the license or permit. It's best to check with the issuing agency for details on the business license cost.State licenses and permits

Federal licenses and permits

Build your team

Team member

Choose from the ones below or type in another.Business bank account

Documens needed

Find a way to obtain the other ones.

Choose from the list or type in the benefits offered by the bank you are interested in.Fees

Brand yourself and advertise

Website

Colour

Typography

Logo

Use it on your company website and on social media.Sales and Marketing strategy

Opt-in forms

Ask for their consent to contact them with further information about your business.

Use opt-in forms. They usually pertain to email communication.

What type of opt-in forms will you use?

Choose from the following or add others.Prices

Marketing channels

The more you use, the better!Business growth

You have some examples here:Business growth idea

Exit strategy

In this way, you can make a substantial profit or at least to limit losses.

Think of an exit strategy or choose from the following examples: Exit strategy idea

Structure

Type of business structure

Learn about the various legal business structures that are available.

It is up to you to determine which type of entity is best for your current needs and future business goals.

What kind of business structure are you interested in?

Type in or choose from the list below.Space

Where you locate your business depends in part on the location of your target market, business partners, and your personal preferences. In addition, you should consider the costs, benefits, and restrictions of different government agencies.State and local taxes

This will help you file your taxes accurately and make payments on time.

Type in costs.Local zoning ordinances

Region-specific business expenses

If you buy, rent, build, or plan to work out of the physical property for your business, make sure it conforms to local zoning requirements.

Neighborhoods are generally zoned for either commercial or residential use. Zoning ordinances can restrict or entirely ban specific kinds of businesses from operating in an area.Finances

The choices you make could affect your taxes, legal requirements, and revenue.Break-even analysis

Use this formula to calculate the break-even point.

Fixed Costs / (Average Price – Variable Costs) = Break-Even Point

Type in the variable costs.

Some examples are:

Type in the average price.

They include such expenses as rent, insurance, dues and subscriptions, equipment leases, payments on loans, depreciation, management salaries, and advertising.

Type in the fixed costs.Funding your business

Business plan

Financial requirements

Show the major areas where the investors’ funds will be spent. These could include:Forecasts

It should not include regular business expenses such as rent, insurance, salaries, etc.

If you are forecasting sales for a restaurant, break down your forecast into these groups: lunch, dinner, and drinks.

Type in some forecasts.Milestones

Show investors that you understand what needs to happen to make your plans a reality and that you are working on a realistic schedule.

Type in milestones (planned major goals).

For example, if you are producing a consumer product, you may have the following milestones:Competitor analysis

Market research

Target market segments

SOM: Your Share Of the Market (the subset of your SAM that you will realistically reach-particularly in the first few years of your business)

SAM: Your Segmented Addressable Market or Served Available Market (the portion of TAM you will target)

The target market refers to consumers with similar characteristics (age, location, income, lifestyle etc.) and are considered most likely to buy a business's market offerings or are likely to be the most profitable segments for the business to service.

TAM: Your Total Available or Addressable Market (everyone you wish to reach with your product)Industry

Business idea

Nowadays, many people are considering starting their own business.

Come up with a brilliant idea, that nobody tried before.

Type in a business idea.Motivation

Reason

¿Por qué utilizar una modelo de mapa mental Mindomo?

Una plantilla tiene varias funcionalidades: