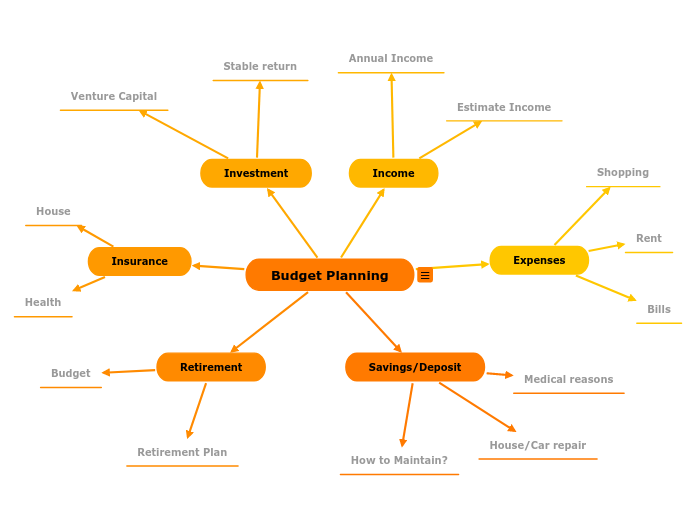

How to use a personal finance planer

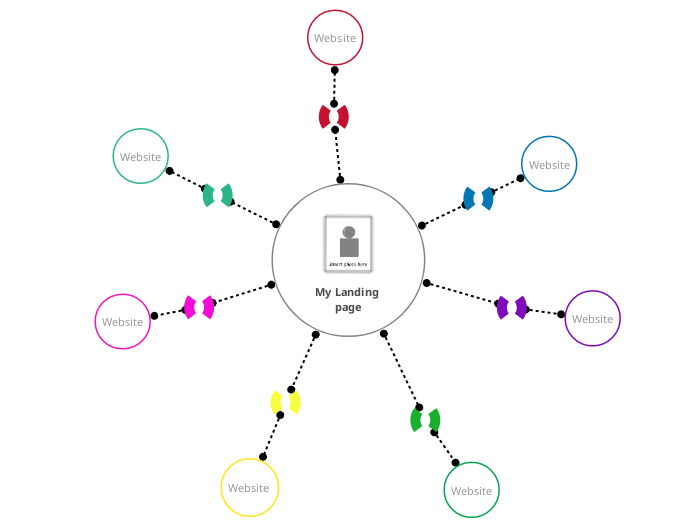

Use this mind map to learn how to make a budget plan and assure your financial well-being. This plan will help you prepare for unexpected expenses and understand where it is wise to invest your money. Calculate your income, expenses, and savings, plan your retirement, choose your insurance and decide where you want to invest your money to maximize your profits.

Budgeting is the process of planning and creating a detailed scheme on how you will spend and/or invest the money you have.

Your expenses are the necessities you are using against cost.

These are recurrent expenses as you would need to pay monthly (rent, bills, etc.) according to your usage.

Income represents the payment you get from your work.

For most people, income is the same for a longer time. So you need to estimate your next year's income to make a financial plan.

If you want higher interest rates than the savings can offer you, you can invest your money.

Investing is not an easy decision as you will bear the high risk with the possibility of loss.

You should do an analysis of different investment programs to maximize your profits.

Insurance is a kind of protection against loss. Anyone can face accidents, and insurance would take the pressure off, as well as support your family.

Plan your retirement and put aside separately for this budget.

A deposit is money you put aside for later use.

If you choose to deposit your money in a bank for a longer period, you can get back a stable interest rate at the end of that period.

You should also know that savings will fluctuate, sometimes you will need to use them sometimes you will be able to put aside more. However, you should maintain the habit of saving money.